Bank Balance Certificate Nepal: Importance & Sample for Study Visa Applications

- Posted by Edwise Foundation

- Categories Blog

- Date December 26, 2020

What is a Bank Balance Certificate?

Bank Balance Certificate is an official document issued by a bank. The certificate clarifies how much fund is available in a specific account on a specific date.

This is a very important document for students wanting to study abroad as it is the mean of proving the university that their sponsors have sufficient funds available in their or sponsors’ account to afford the expenses of the students.

While getting the Bank Balance Certificate issued, the student needs to remember that they will have to convert the amount to the currency of the country they intend to apply to based on the exchange rate of the particular day.

Also read; SOP for Accounting (Statement Of Purpose For Accounting)

How can you get your bank Balance Certificate online in Nepal?

Most banks offer this service online. All you need to do is to visit the website and file the request for the document. There are specific fields that are mandatory, and you need to fill them to receive the certificate.

Also read; Visa Success Rate for Canada From Nepal

Why do you need a Bank Balance Certificate?

Bank Balance Certificate is needed to justify that the student has enough funds for studying in the specific university and will not have any financial issues and will not need to work to meet the expenses.

How can I apply for a Bank Balance Certificate in Nepal?

Writing an application for bank balance certificate is very simple. Usually, the banks have their own format and is available both online and, in the banks physically.

All you need to do it fill the application and submit it to the bank. If there are no forms provided by the bank than a student needs to write an application expressing their desire to get the bank balance certificate.

You will need to mention the purpose of you needing the certificate, account number and type, your full name and address and the fact that the amount needs to be stated in the currency of the country that you intend to study in.

Also read; What is No Objection Letter (NOC) | Obtaining NOC from Nepal

How do I apply for Bank Statements in Nepal?

The process of application is more or less the same for both bank statements and bank balance certificate. The only additional thing you will need to mention in your application for bank statements is the duration for which you will require the statement.

What is the difference between Bank Certificates and Bank Statements?

Bank Certificate is merely a letter from the bank that states the amount the account holder has on a particular date for which the certificate is requested.

However, the Bank Statement is the detailed transaction history of the account holder since a specific date to another specific date.

Also read; Affidavit of Support for a Student Visa

The Bank Statement will have records of every single transaction done throughout the period of which the statement has been requested. Usually, a student needs the statement for 6 months, but it could vary as per the destination or the university you are applying to.

For example, any student wanting to apply for the UK will require the statement for 28 days and a student wanting to apply for Australia will require the statement for the last 6 months, and if the student is wanting to apply for the USA then some universities may request the bank statement for the last month or last 3 months or past 6 months.

Which type of Bank Statements is required for visa?

Generally speaking, a student will need to present the bank statement of their sponsors. The bank account has to be ‘Saving’ in Nature. Bank statements of business accounts may be used as well but for that the sponsor needs to be the owner of the business.

It’s better they do not use it if the account is an ‘Overdraft’ category. Current Account can be presented but not in place of Savings Account.

Also read; Statement of Purpose (SoP) for Study Abroad

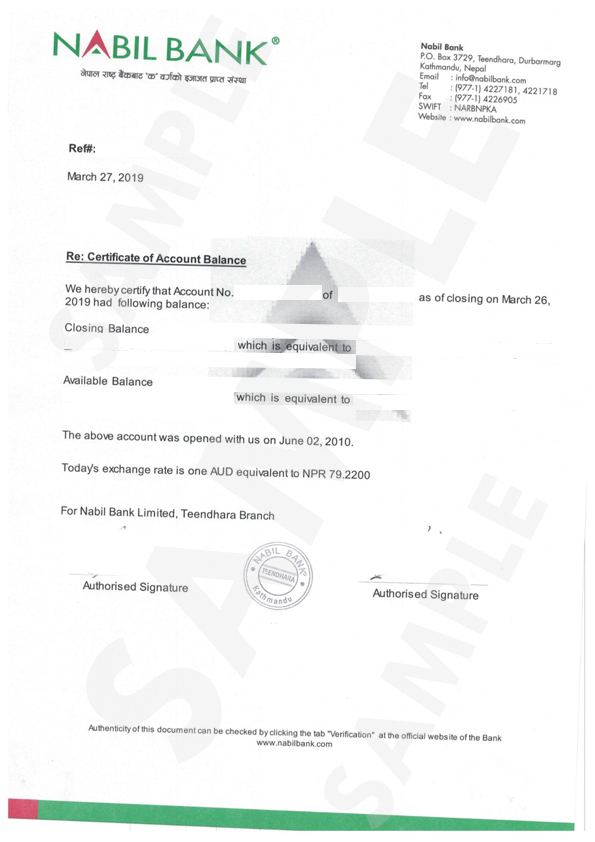

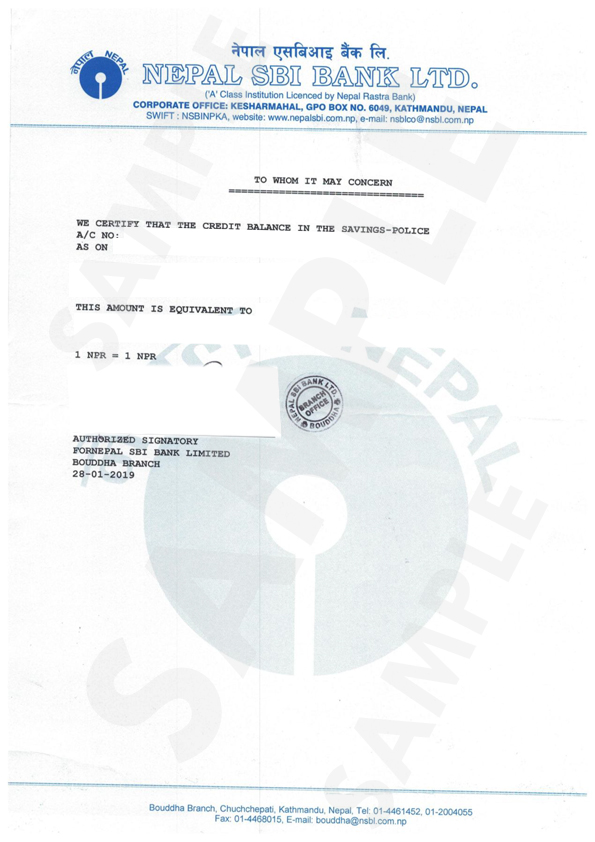

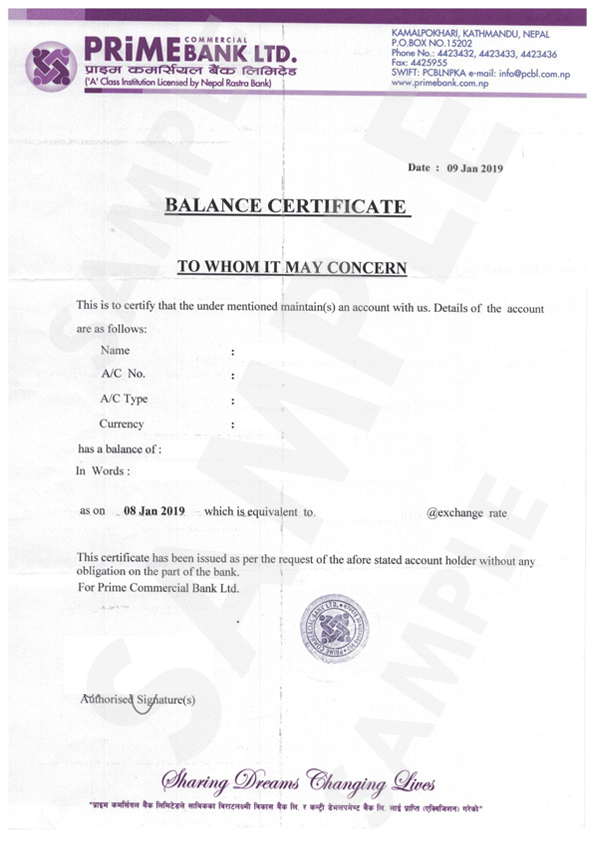

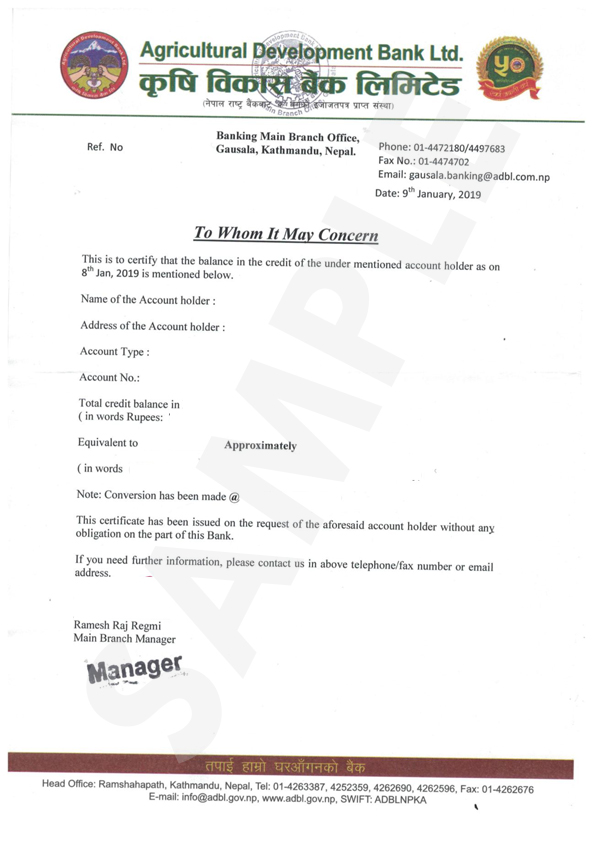

Bank Balance Certificate Sample

[IMPORTANT NOTE: This sample gives an idea as to what the Bank Balance Certificate is like. Each bank has their own formats.]

{Bank Certificate Issued Date}

Subject: Balance Certificate

This is to certify that { ACCOUNT HOLDER’S FULL NAME} has been maintaining { SAVING A/C MAINTAINED } with Account Number { ACTIVE A/C NUMBER} with us since { A/C OPENING DATE}.

The total balance in the account as at closing of {DATE} is NPR. 00,00,0000.00 (in words), which is equivalent to {the amount in required currency} at the prevailing exchange rate of (exchange rate}.

This certificate has been issued on the request of the account holder without any risk and liability whatever on the part of the bank and/or its officers whose signature(s) appears in this certificate.

Authorized Signatures with Authorized Stamp

[THIS SAMPLE IS ONLY FOR REFERENCE PURPOSE.]

What is a One-day bank balance certificate for Canada visa processing?

A one-day bank balance certificate is a document provided by a bank that shows the account balance for a specific account on a particular day.

Some study permit applicants for Canada use a one-day bank balance certificate to prove their financial stability. But, we highly discourage students from using a one-day bank balance certificate for Canada study permit application for the following reasons:

- One-day bank balance shows only your account information of a specific date; thus, it fails to demonstrate your long-term financial stability. Long-term financial Stability could be demonstrated through bank statements of a certain duration (normally 3-4 months).

- In many cases, applicants temporarily deposit money for a day to increase the account balance and withdraw the money the next day after the certificate is issued. Visa officers are aware of the trend. Therefore, such practices could reduce your visa chances.

Thus, we highly recommend students go for an education loan or about 3-4 months’ bank statement and not use the one-day bank balance.

How much bank balance is required for a Canada study visa?

Answering the specific bank balance amount required for a Canada study permit is difficult. Students are required to demonstrate financial sufficiency for only the first year of studies, regardless of the duration of the course or program of studies in which they are enrolled.

The amount can vary depending on your course fees, duration, location, etc. Generally, while applying for a canadian study permit you will need to show that you have enough funds/bank balance to cover the following expenses:

- Tuition Fees

- Living Expense

- Ticket costs

- Cost of books, equipment, and supplies

- Transportation cost

To simplify this, all provinces except Quebec require $10,000 for twelve twelve-month periods, prorated at $833 per month plus the cost of tuition.

Please ensure that the funds are genuine and readily available while applying for your study permit.

Dreaming of Studying Abroad? Take the First Step with a FREE Consultation!

Tag:Course

Edwise Foundation is your dedicated abroad education partner. We are more than an education consultancy; we're your route to international education. We have a long history of guiding ambitious young minds. Our extensive experience in counseling abroad studies and smooth application processing makes it easier for students to achieve their academic goals.

f i y t n

You may also like

How To Write A Letter of Sponsorship For Student Visa